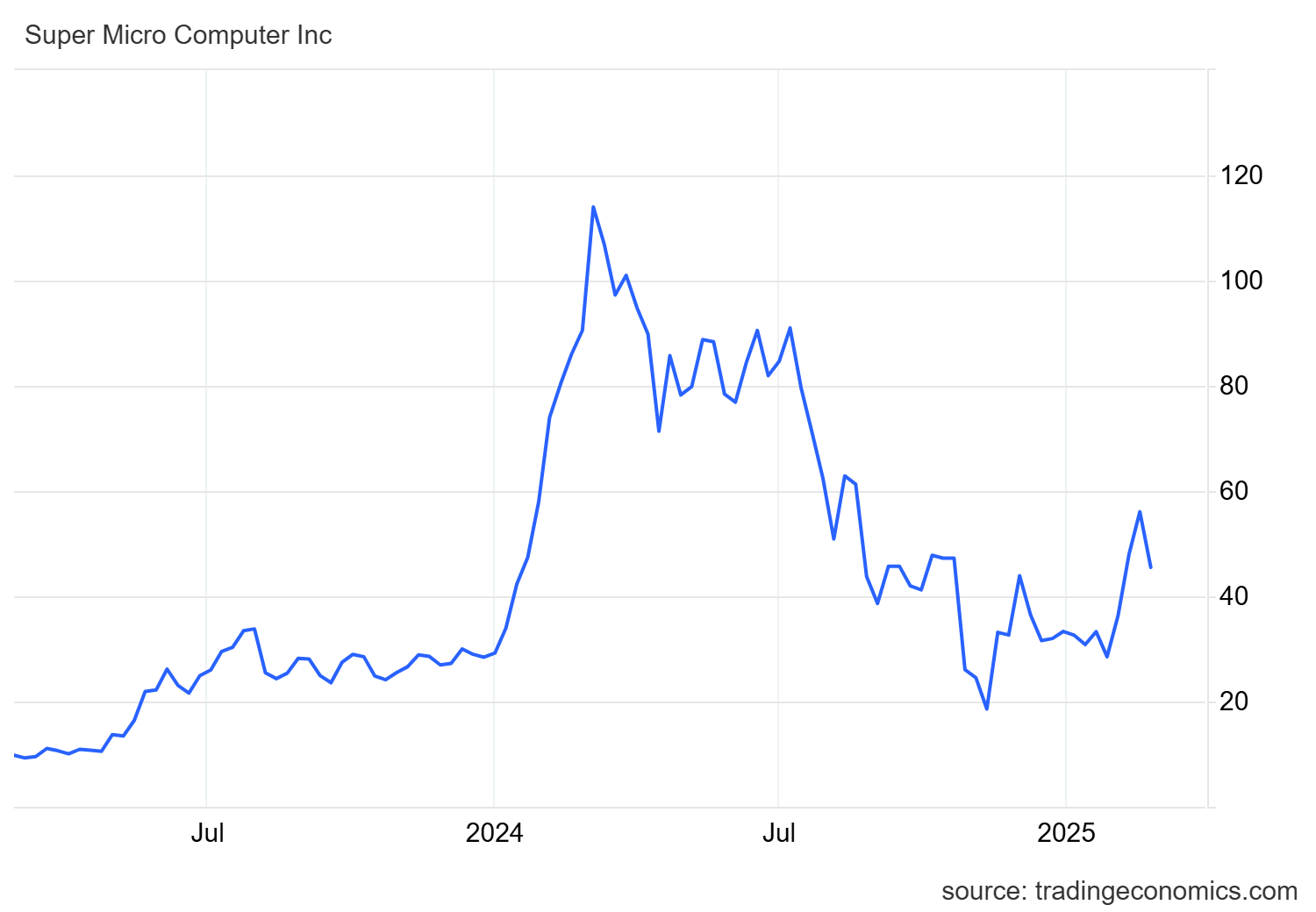

Super Micro Computer Inc. stock price performance over the past five years *

Strong financial results

What caught my attention in this case is that despite the problems with internal controls and the replacement of the auditor, the company achieved significant sales growth. In 2024, revenue more than doubled to $14.99 billion, indicating that the business is in great shape.

Nevertheless, I cannot help but notice the risks that are still associated with the company. Late filing of reports can lead to lawsuits, reputational damage, and a possible downgrade in your credit score. Although Super Micro is working on recruiting new accountants and auditing staff, as well as modernizing IT systems, the fact that the company has identified weaknesses in internal controls, including a lack of segregation of work duties and manual accounting entries, suggests that the situation is not yet fully resolved.

Super Micro benefits from the AI boom and collaboration with Nvidia

However, from the perspective of long-term growth, it is important to me that Super Micro benefits significantly from the growing demand for AI computing systems. The company has become a key player in the AI server segment and is working with Nvidia to produce powerful servers with their GPUs, which are essential for the development of advanced artificial intelligence.

More interestingly, Elon Musk's xAI is also among Super Micro's customers, giving the firm another level of credibility and growth potential. The market trend is clear. The demand for AI computing infrastructure is at all-time high, and companies that can keep up in this segment are highly likely to profit. [1]

My investment perspective

Although Super Micro still faces some financial and reputational risks, its surge in AI technology and successful listing are clear positive signs. If the company continues to strengthen internal processes and maintains the current growth trend in the AI sector, I think its shares have room for further strengthening. [2] I will therefore closely monitor developments in the coming quarters, especially the improvement of the company's management and the demand for its AI servers. For tech investors like me, Super Micro can still be an interesting opportunity.

* Past performance is no guarantee of future results

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.

Sources:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001375365/000137536525000004/smci-20240630.htm