In the investment world, there are companies that just follow trends, and then there are those that create them. Palantir Technologies is definitely in the second category in 2026. The latest financial results for the fourth quarter not only exceeded analysts' expectations, but showed the company's transformation from a visionary startup to a highly profitable giant that stands at the center of global business.

Financial performance

The end of fiscal 2025 was a breakthrough for Palantir. The company reported earnings per share (EPS) of $0.25, beating the market consensus at the same time. Total revenues also saw a significant increase, rising 70% year-over-year to $1.41 billion.

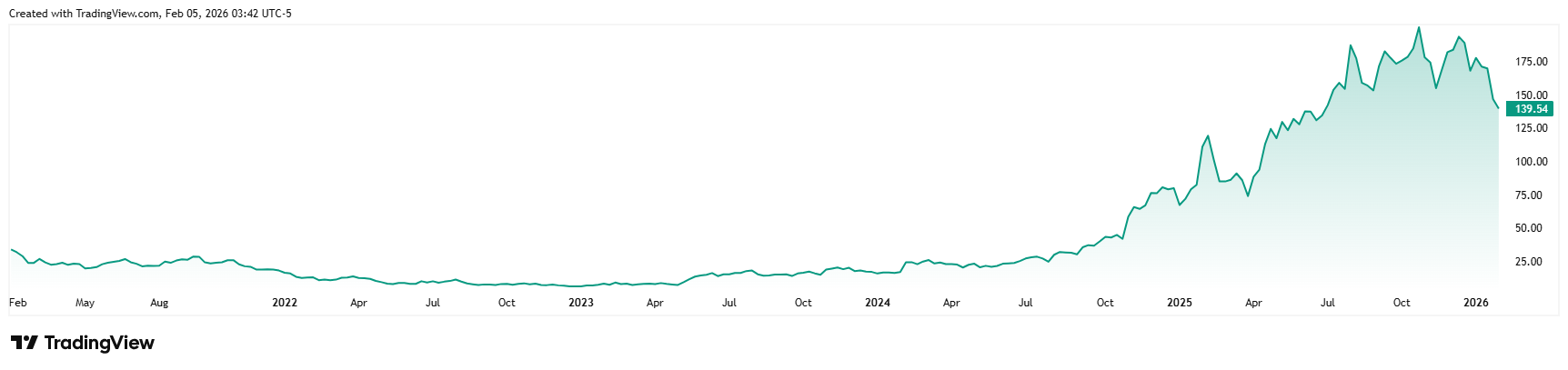

Palantir's share price performance over the past five years*

For the full fiscal year 2025, the company generated consolidated revenues of $4.48 billion. A relevant indicator of increasing efficiency is net profit – while it reached USD 79 million in the previous period, it increased to more than USD 608 million in the current reporting period. This progress confirms the high degree of scalability of the company's business model.

Strategic dominance

Palantir's stability is anchored in two key divisions, with the government sector showing accelerated growth dynamics of 66%. The company has established itself as a strategic technology partner for the U.S. Department of Defense, Department of Homeland Security, and the U.S. Navy.

The implementation of a $10 billion framework contract with the U.S. Army and a $448 million contract to optimize production processes in the Navy confirm that Palantir's software solutions are currently considered critical infrastructure for Western allies.

AI Integration

While government contracts ensure cash-flow stability, the commercial sphere benefits from the growing demand for AI implementation. Palantir has achieved a competitive advantage in the field of large language models (LLMs), which enable the transformation of unstructured data into strategic business information.

The strategic partnership with Nvidia further strengthens Palantir's position as a leader in the practical application of AI solutions. In this context, CEO Alex Karp emphasizes that product development is carried out strictly in accordance with ethical standards and the legislative framework for the protection of privacy, which is crucial for cooperation with state agencies.

Forecast for 2026

Despite the stock's 81% year-over-year appreciation, the start of 2026 brought a 15% price correction, which, based on fundamental strength, can be seen as a favorable opportunity to strengthen the portfolio.* Looking ahead, this idea is supported by Palantir's fiscal 2026 revenue forecast of $7.198 billion. [1]

* Past performance is not a guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which is subject to change. Such statements are not a guarantee of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

Sources:

https://www.palantir.com/q4-2025-letter/en/

https://www.cnbc.com/2026/02/02/palantir-pltr-q4-2025-earnings.html