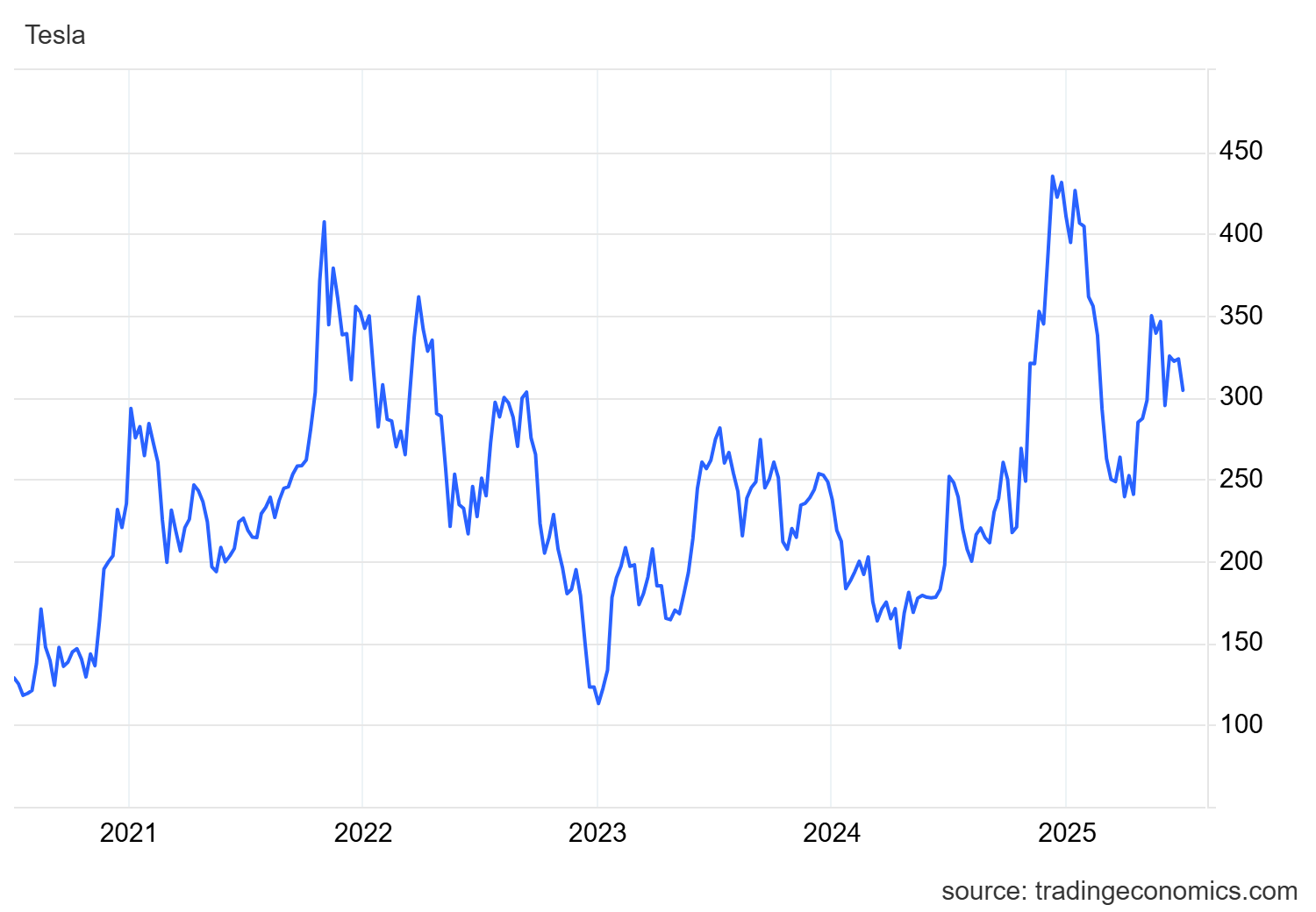

Tesla's share price performance over the past five years*

Declining sales and intensifying competition

Market forecasts are even more sceptical. The Kalshi platform estimates deliveries at just 364,000 vehicles. In addition, the expected decline comes at a time when competition in the electric car market is growing significantly, traditional car manufacturers are increasingly entering the electromobility segment, which Tesla is already noticeably feeling in its results. The American manufacturer is aware of this dynamic, so with the latest step it is trying to gain a competitive advantage back on its side, namely by launching the long-awaited Robotaxi project in Austin.

Political tensions

The resulting situation in which Tesla currently finds itself is not improved by the political engagement of its CEO, Elon Musk. He openly criticized the new legislative proposal "One Big Beautiful Bill Act," initiated by President Donald Trump. Musk said the bill would disproportionately increase the U.S. deficit and limit funding for renewables. In addition, it would abolish tax breaks for electric cars, which, of course, would significantly affect Tesla's sales. Trump did not take long to respond, accusing Musk of being angry because he was losing his "EV mandates."

Impacts on Tesla Energy

However, it is not only Tesla itself that is at risk, but also its subsidiary Tesla Energy, which manufactures solar panels and battery storage. According to estimates by Energy Innovation, the reduction in sales of electric cars could cause a shortage of up to 100,000 units per year by 2035. This would also slow down the development of renewables by more than 350 GW cumulatively by the same year. Understandably, the shortfall could seriously damage the growth of Tesla Energy, which has so far benefited from strong support for environmental regulations and tax incentives.

Dependence on public funds

Musk's projects, such as the aforementioned Tesla or SpaceX, are generally largely dependent on public funding. Since 2008, SpaceX has raised more than $22 billion through contracts with the U.S. government, while Tesla has earned about $11.8 billion just from the sale of environmental regulatory credits. In the second quarter of 2024, this revenue accounted for up to 60% of Tesla's net profit. Investors are therefore aware that Tesla is currently living up to its occasional epithet – more than just a car manufacturer.

Looking to the future

From an investment point of view, Tesla may represent an interesting investment opportunity for some investors, but at the same time, this company also carries a high level of risk. Primary threats? Declining sales, growing competition, political conflicts and possible legislative changes. Can the company effectively deal with all this and grow in the stock market based on justified factors?

* Past performance is not a guarantee of future results.

Resources:

https://www.cnbc.com/2025/07/01/tesla-shares-fall-7percent-ahead-deliveries-musk-trump-feud.html

https://www.cnbc.com/2025/06/23/tesla-stock-robotaxi-austin.html